Inflation Makes It Harder For Americans To Buy A House

The Federal Reserve has raised interest rates aggressively this year in response to rapidly rising inflation and prices. That makes it harder for Americans to buy a house.

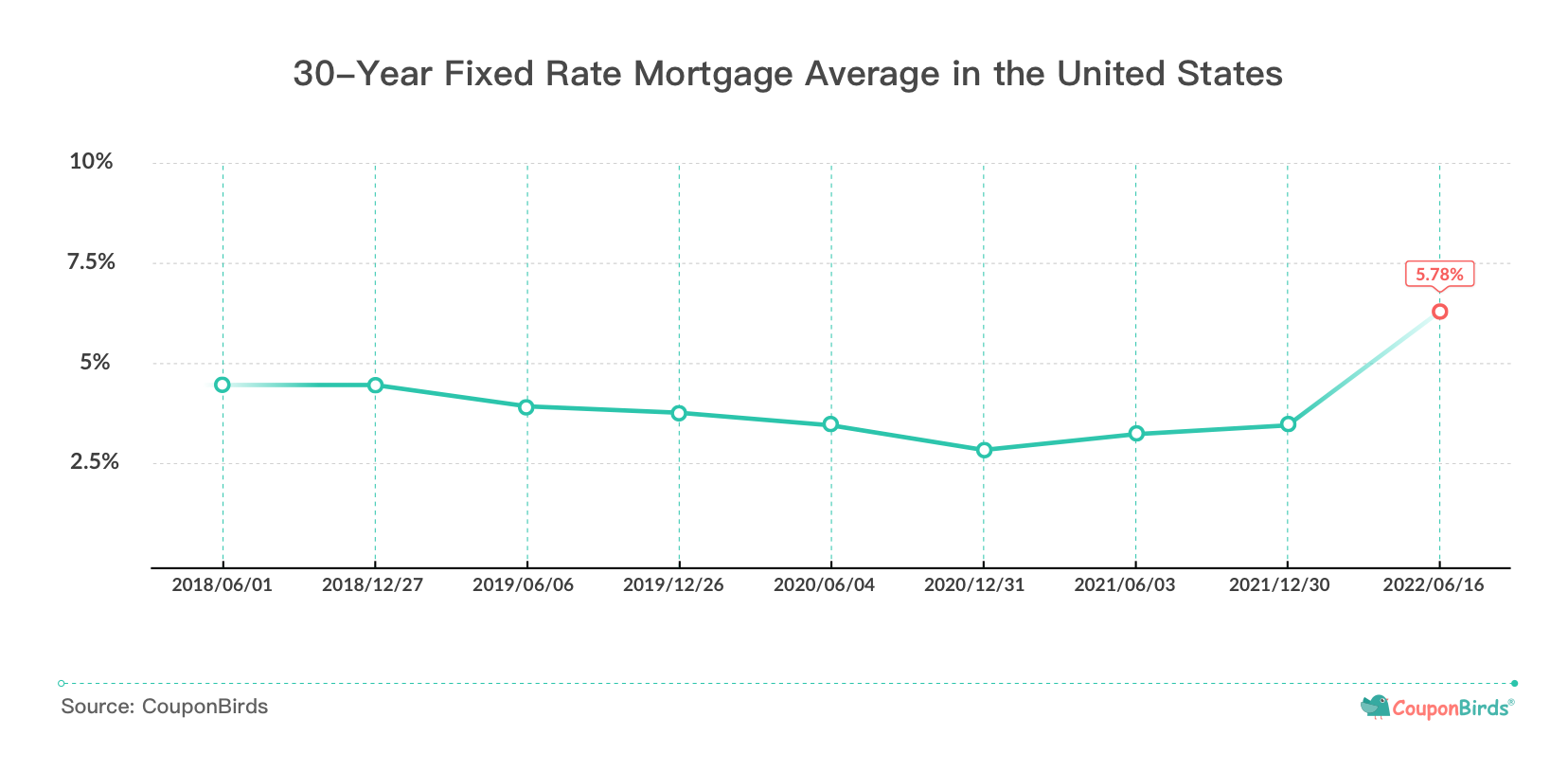

The 30-year fixed rate mortgage average rose rapidly in early 2022, briefly reaching levels last seen during the 2008 financial crisis, according to Federal Reserve data. Mortgage rates stayed flat between 2018 and 2021, but surged to 5.78% this year, an astonishing 85% increase. It was unimaginable a few years ago. The change has left buyers paying hundreds of dollars more monthly than they did a year ago. That is a heavy burden for people who already have mortgages and a deterrent for families looking to buy.

In addition, the HPI (House Price Index) has increased significantly in the top 100 metro areas, according to the Federal Housing Finance Agency. Of these areas, four saw HPI increases of more than 30%, and 30 areas saw HPI increases of more than 20%. Cape Coral-Fort Myers, FL, for example, saw its HPI increase of 41.3% in the 2022 first quarter, the highest in the top 100 metro areas. The national average HPI rose by 18.9% a year. That suggests prices are rising too fast for many buyers to afford.

In addition, soaring food prices are draining Americans' wallets. The Consumer Price Index rose 8.3% in the year to April, the highest increase since 1981. Meat and dairy prices have also risen sharply. Bacon was up 17.7%, chicken 16.4%, butter 19.2%, and milk 14.7%. This means most ordinary families will spend more on food than they do on other things, exacerbating the pressure on potential house buyers.

The following figures show that housing sales have been hit since June 2021. With mortgage interest rates rising sharply, total existing home sales have turned to negative growth this year. In May of last year, home sales increased 45.5%. A year later, home sales were down 8.6%. It can be seen that the enormous growth of mortgage interest rates has a huge impact on the real estate industry, greatly weakening buyer confidence.

The primary cause of the surge in mortgage rates is inflation, which began to escalate worldwide in early 2021. The 2021-2022 inflation surge was attributed mainly to supply shortages caused by the COVID-19 pandemic and the Russian invasion of Ukraine. As the pandemic receded, historically strong job and wage growth drove up consumer demand. As a result, many countries have seen their highest rates of inflation in decades. Between 2020 and 2022, U.S. inflation increased by about 7%, rising at an alarming speed.

Fed Chairman Jerome Powell said at the FOMC meeting that it expects to raise rates by 50 or 75 basis points at the next meeting in July, and rate hikes are likely to continue in 2023. There are signs that house buyers have already encountered a financial crisis. This requires strict management of their household budget and finding ways to save money on necessities.

References

1. FRED Economic Data, "30-Year Fixed Rate Mortgage Average in the United States".

2. Federal Housing Finance Agency, "FHFA HPI Top 100 Metro Area Rankings".

3. Wikipedia, "2021–2022 inflation surge".